5 Tornado Method Mistakes That Will Slow You DOWN!

The Tornado Method of paying off debt can be your fast track to getting that one debt that causes you to lose the most sleep at night out of your life FOREVER.

But, to be successful, there are a few common mistakes you need to avoid. Making any one of these mistakes may not prevent you from ever paying down the debt, but they will definitely slow down your progress.

And no one needs that!

So, let’s talk about them so you successfully avoid them!

Mistake #1: Not Having a SPECIFIC DEBT in Mind

The first mistake I see with people who decide to use the Tornado Method is trying to attack ALL of their debts at once. The most successful people target ONE SPECIFIC DEBT with this method. It’s the debt that keeps them up at night the most.

That does not mean it’s the debt with the highest interest rate or the highest balance. It’s the debt that causes them the most anxiety, frustration, or even anger.

But, what sometimes happens is that a person will try to attack ALL of their debts with this method at the same time. This approach usually fails or at least doesn’t have as positive an outcome, because none of us can sustain the level of EMOTION needed for this method towards ALL of their debts.

Mistake #2: Not COMMITTING To the Tornado Strategy

The Tornado Method, or strategy, of repaying your debt is all about EMOTION.

That is, it’s all about focusing your energy and every extra dollar possible toward paying down whatever debt you’re trying to eliminate from your life.

But, unless you COMMIT to the strategy, it’s going to be difficult to be successful. Whenever I’ve seen clients be super successful with the Tornado Method, it’s because they decided that no matter what that debt was going away.

Additionally, they acknowledged and accepted that the process was going to be more of a marathon than a sprint. They accepted that they were going to need to work toward their goal for weeks, if not months and that was okay.

Mistake #3: Not Having a PLAN

The third mistake I see people make when trying to implement the Tornado Method is they don’t step back, take a breath, and make a plan. Yes, the Tornado Method is all about focusing the negative emotions you feel about the debt towards getting rid of it, but that doesn’t mean going off half-cocked and without a plan.

What are you going to do differently to get this date paid off and out of your life? Work extra shifts? Do some consulting on the side? Sell jam at the Farmer’s Market throughout the summer? I once had a client who wanted to pay off his student loans. He spent all summer building backyard decks for family and friends. It was hot, back-breaking work, and he spent all of his evenings and weekends pounding nails and digging post holes, but by the end of the summer, he’d met his deadline and gotten most of the debt paid off! #Winning!

This brings me to the next mistake when implementing the Tornado Method…

Mistake #4: Not Having a Target Date

The Tornado Method takes a lot of energy and focus, so do yourself a favor and give yourself a Target Date to be finished. Giving yourself a date makes your plan more concrete. Because let’s face it, a plan without a deadline is a wish. And, well, if wishing debt away worked we’d all be better off!

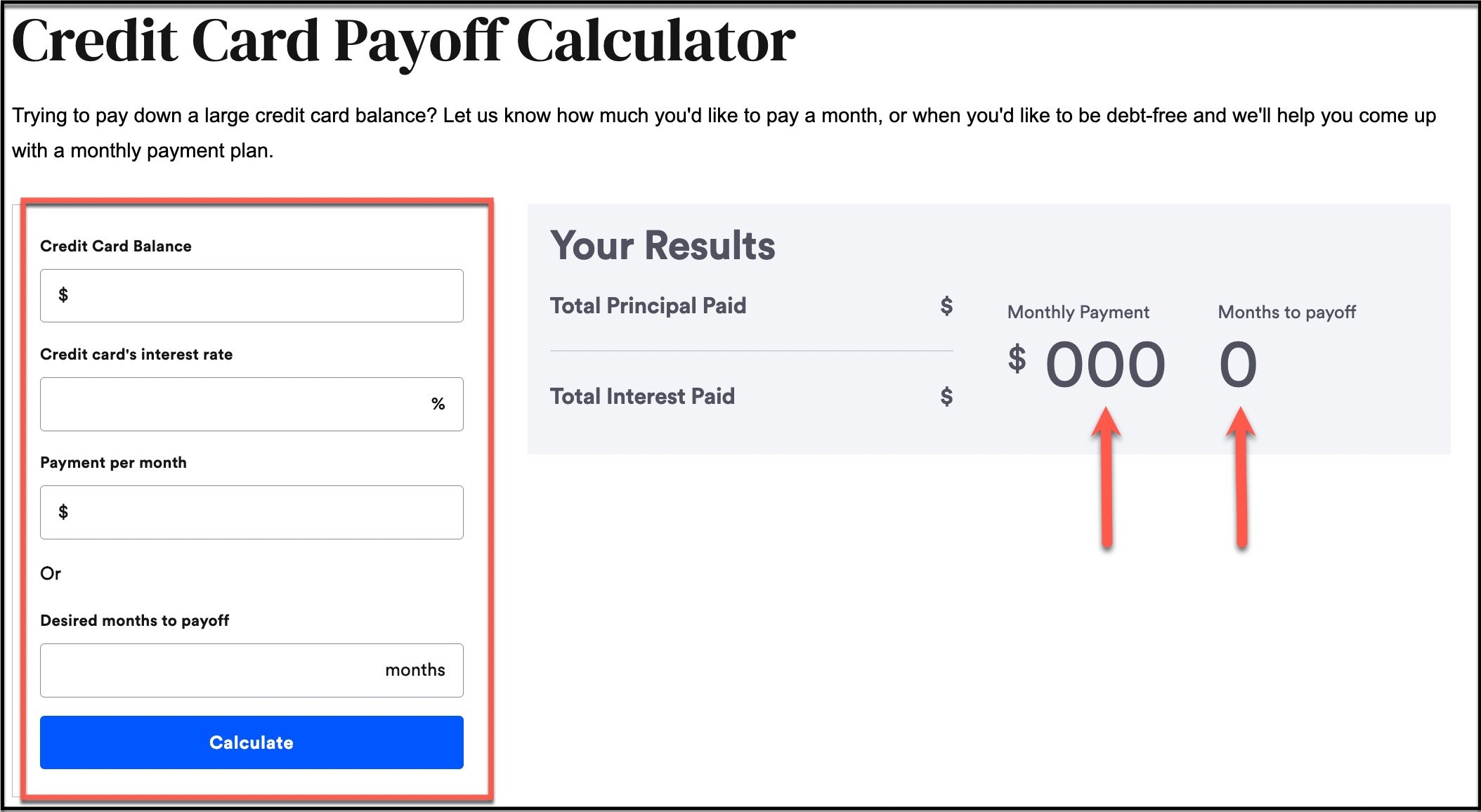

To figure out a reasonable target date, you’ll need to use a calculator. But, don’t worry! Bankrate.com has a calculator specifically for calculating how long it will take to pay off the debt, whether it’s a credit card, car loan, or even a mortgage. You enter the total amount of the debt, the interest rate, and the number of months you would like to pay the debt off and Bankrate will tell you how much you need to pay in order to make that happen.

You can find the Bankrate Credit Card Payoff Calculator HERE

Play around with it and see what’s feasible for you and your situation and then lock in that Target Date!

And remember - it’s a marathon, not a sprint. Even though you’re focused on this debt, it might take you weeks or months to get it completely paid off and that’s okay!

Mistake #5: Not Being Willing to Say NO to More Debt

What many do not realize is that part of getting out of debt is breaking the habit of being in debt. Yes, using your credit card instead of paying with your debit card is a habit.

What can happen when you’re under financial stress is you start to become a bit afraid of using the cash in your checking account either because the balance is so low, or, in case you need it. Using credit cards feels “safer” than using your cash. What can then happen is you default to using your credit cards - without even realizing it sometimes!

Breaking the habit of reaching for your credit card first can take some time. We all have lots of emotions wrapped up in our money, so be gentle with yourself. 🙂 🙂 🙂

However, being unwilling to say No to more debt, even if it's painful in the short run can offset any gains you may have with your Tornado debt!

Conclusion

The Tornado Method is all about focusing the negative emotions you have towards a specific debt to eliminate it from your life. It doesn’t care about which debt has the highest interest rate or the largest balance. The whole method is about harnessing emotion.

However, because the Tornado Method does not focus on the interest rate or balance due, paying it off can take some time. So, remember, it’s a marathon not a sprint! Paying this debt off might take you weeks or months and that’s okay. Because you’re making progress!

You’ve SPECIFIED which debt you’re going to tackle, you’ve COMMITTED to the process, you’ve made your PLAN, you’ve set a TARGET DATE, and, finally, you’ve SAID NO to more debt!

You have set yourself up for success! Now, it’s time to work your plan!

Good Luck! And please do DM me once you’ve got it done. I want to celebrate with you!

Love,

~Michelle

**I am not a licensed financial advisor. I am a money expert and I offer education, tips, tricks, and my opinions about money. You should consult a professional who understands your needs in order to make the best decisions for you! Additionally, some links in this blog may be affiliate links, which means if you click the link and buy the product I may earn a small commission - at NO COST to You! It’s one of the ways I keep the lights on around here so TYIA! 😉